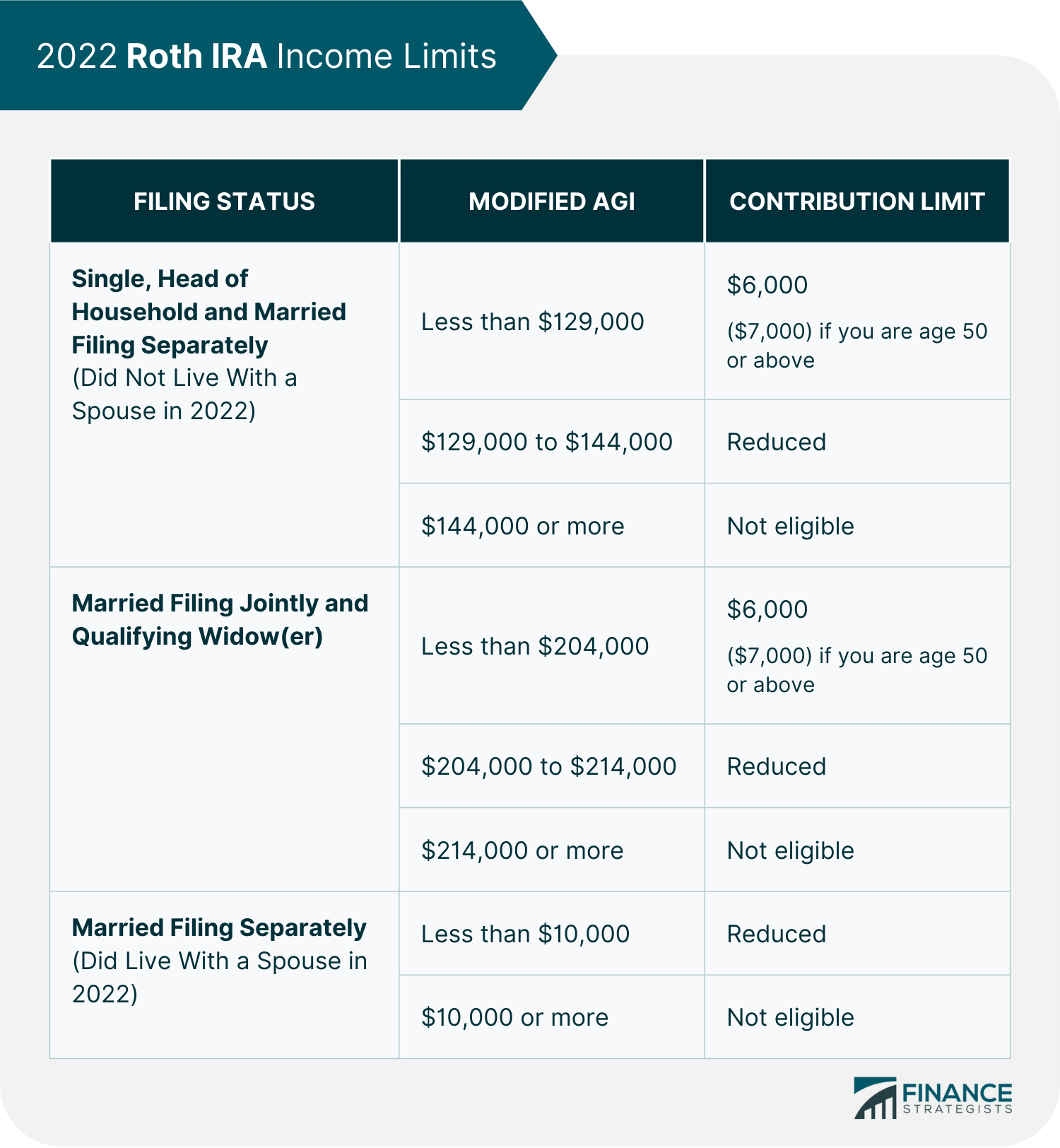

2025 Roth Income Limits Married In India. — if you are married, filing separately, and you lived with your spouse at any time during the year, your roth ira income limit for 2025 is $10,000. — if you are part of a married couple filing jointly or a qualifying widow or widower with modified adjusted gross income of under $230,000, you can save the maximum in a roth.

Roth Ira Limits 2025 Married Isa Marnia, — here are the roth ira income limits for 2025 that would reduce your contribution to zero:

Roth 401(k) limits in 2025 Estradinglife, — learn about the roth ira income limits for 2025, including updates and strategies for maximizing your contributions and retirement savings.

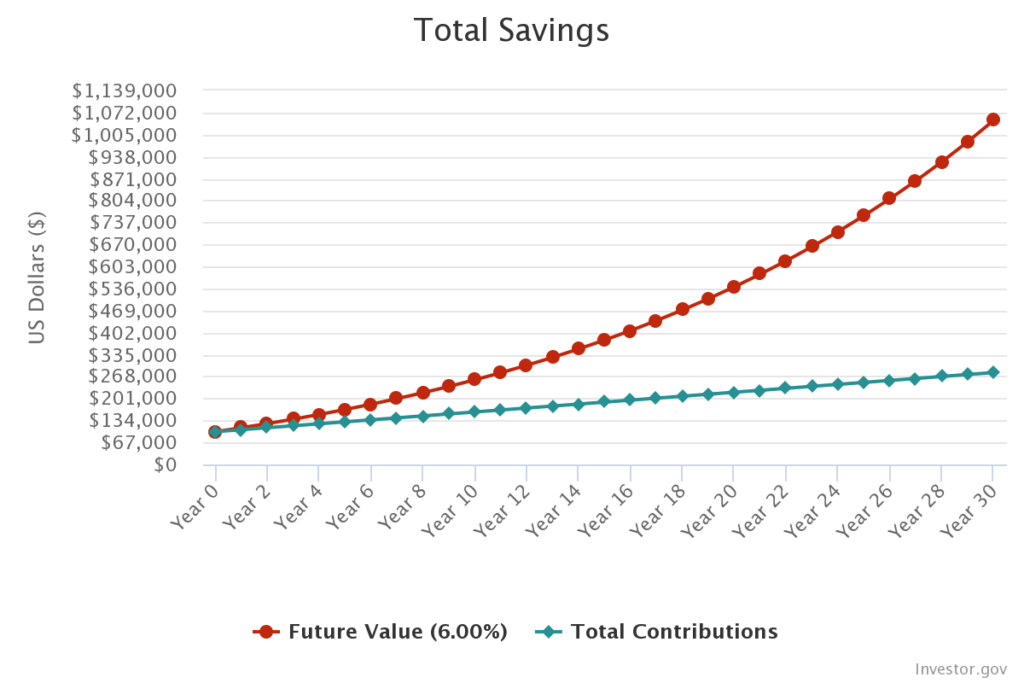

Roth Ira Limits Married Filing Jointly 2025 Kassi Matilda, — the limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $6,500 or $7,500 if you were age 50 or older.

Roth Ira Limits 2025 Married Sydel Katharina, — learn about the roth ira income limits for 2025, including updates and strategies for maximizing your contributions and retirement savings.

Max Roth 401k Contribution 2025 Married Alaine Mufinella, — learn about the roth ira income limits for 2025, including updates and strategies for maximizing your contributions and retirement savings.

Roth Ira Limits Married Filing Jointly 2025 Kassi Matilda, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.

Roth Ira Limits 2025 Phase Out Ibby Cecilla, You’re married filing jointly or a qualifying widow(er) with an agi of $240,000 or more.

Maximum Roth Ira Contribution 2025 Married Dasi Timmie, — to be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year) if single or between $230,000 and.