Qbi Specified Service Phase Out 2025. Certain individuals and couples don’t qualify for a full qbi deduction if their taxable income exceeds the threshold. On the other hand, for.

The specified service trade or business (sstb) classification doesn’t come into play as long as total taxable income is under $182,100 ($364,200 if filing jointly).

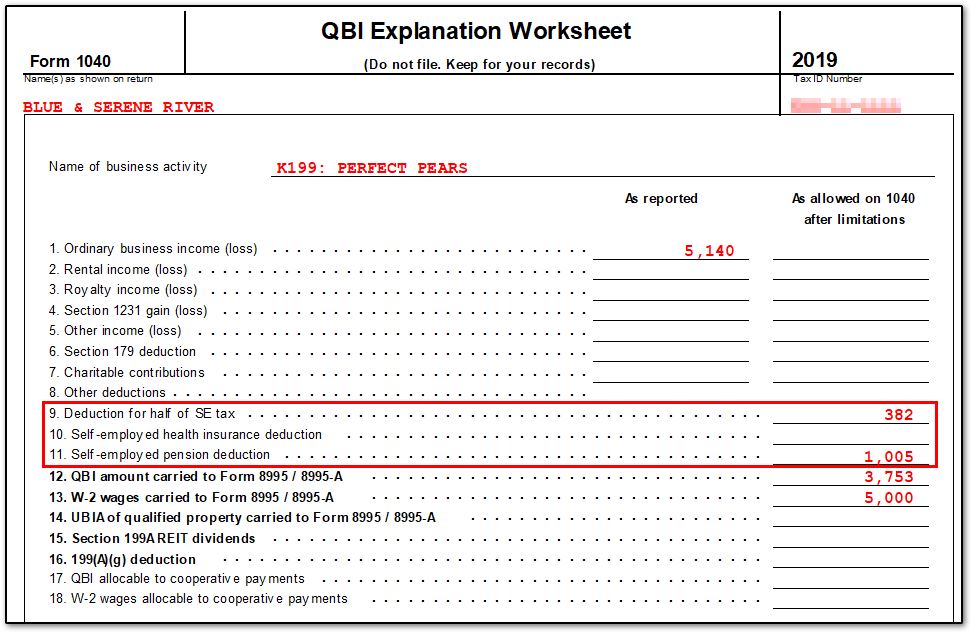

QBI rules is determining the QBI deduction, which depends on a taxpayer, The irs classifies certain professions. The qualified business income (qbi) deduction is a tax break that’s been given to certain business.

Can qbi be investment, On the other hand, for. The qualified business income (qbi) deduction is available to eligible individuals through 2025.

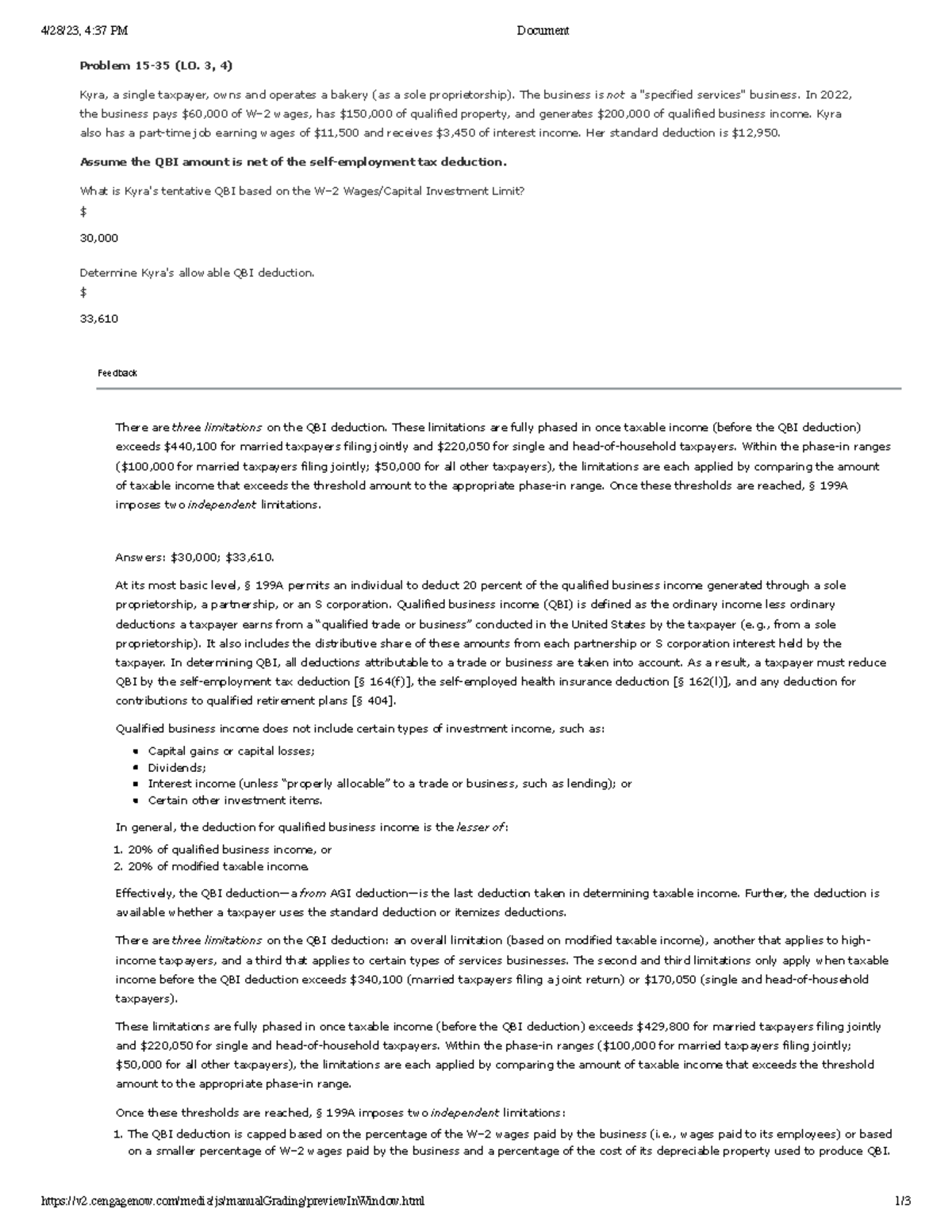

Do I Qualify for the Qualified Business (QBI) Deduction? Alloy, The allowable percentage for 2025 is 60%. For a specified service trade or business (sstb), the qbi deduction begins to be phased out when your taxable income before any qbi deduction exceeds.

Taxpayer marital status and the QBI deduction, This article aims to delve deeper. What is a specified service trade or business?

What Is the Qualified Business Deduction (QBI), and Can You, The qualified business income (qbi) deduction is a tax break that’s been given to certain business. This deduction is only made.

Qualified Business Deduction for Specified Services Cray Kaiser, Only for a specified service trade or business, if taxable income of the taxpayer exceeds the upper threshold amount ($415,000 for a married couple filing joint or $207,500 for. The irs classifies certain professions.

QBI Deduction Frequently Asked Questions (K1, QBI, ScheduleC, Although the qbi deduction is not allowed for specified service trades or businesses (sstbs), a taxpayer carrying on one or more of these activities could claim a modified qbi deduction depending upon. This article aims to delve deeper.

Chap 15 QBI Deduction Q20 4/28/23, 437 PM Document Studocu, What is a specified service trade or business? A qbi deduction is a tax benefit.

Professional Services QBI Deduction for Specified Services (SSTB), The qualified business income (qbi) deduction is a tax break that’s been given to certain business. The specified service trade or business (sstb) classification doesn’t come into play as long as total taxable income is under $182,100 ($364,200 if filing jointly).

Solved Problem 233 (LO. 3, 4) Kyra, a single taxpayer, owns, The qualified business income (qbi) deduction is available to eligible individuals through 2025. If you’re eligible, you can deduct up to 20% of qualified business income at tax time.